India’s Currency Woes: Why Worry?

Representational Image. Image Courtesy: Pexels

In a recent interview with The Indian Express, Pranjul Bhandari, Chief India and ASEAN Economist at HSBC, argued that a weakening rupee is “the perfect medicine” for the problem of elevated tariffs. A similar note of reassurance was struck by Chief Economic Adviser V. Anantha Nageswaran, who said he was “not losing sleep” over the rupee’s fall.

Such statements and confidence, however, are difficult to share. Treating currency depreciation as a largely benign—or even beneficial—development risk, overlooking its deeper and more persistent economic costs. Focusing only on the perceived upside of such disruptions, while ignoring their long-term consequences for investment, stability, and growth, may prove far more expensive for the economy in the years ahead.

A low inflation rate in India is not a shield against the negative effects of a falling rupee. India is already facing a consumer price index of 197.3, which means what used to cost ₹100 in 2012 now costs ₹197.3. Moreover, except for a few years, the consumer price index has never declined since 2012 (see Figure 1). A low inflation rate means inflation is increasing at a decreasing rate; it does not mean prices are declining.

Figure 1. Source: RBI Data

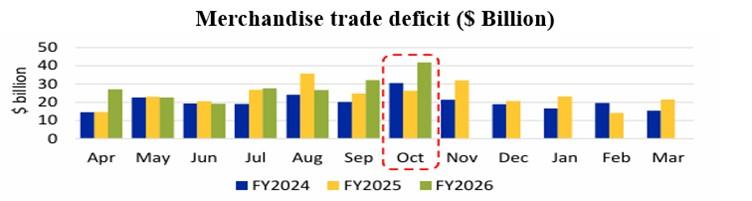

In light of a record increase in merchandise trade deficit (MTD) and the rupee breaching 91-per-dollar for the first time on October 17, 2025, some economists believe that a weakening rupee is the ideal solution to the problem of high tariffs from the US, without considering its long-term negative effects.

This kind of thinking may stem from the motivation that when a country’s currency depreciates, it makes its products cheaper for other countries to buy and import, thereby increasing the country’s competitiveness in the global export market. When demand for a country’s exports rises, export revenue increases, leading to more employment opportunities and ultimately boosting economic growth.

However, in reality, the main beneficiaries of rupee depreciation are the financial markets, not exporters. Exporters dislike rupee volatility because Indian exports are not highly competitive and often rely on imported inputs, so a weaker, unstable rupee raises their costs and creates pricing uncertainty. Consequently, currency depreciation does not necessarily lead to higher export gains, whereas financial markets profit from volatility.

There are several aspects that can be impacted by rupee depreciation, such as increasing import costs, widening the trade deficit, raising corporate foreign debt burdens, capital flight, and creating future inflation pressures. Even in a low-inflation-rate environment, depreciation remains a serious macroeconomic concern.

Let us look at how the rupee devaluation will negatively affect the Indian economy. India’s MTD already widened sharply to $41.68 billion in October 2025, up from $26.23 billion a year earlier (which means MTD increased by approximately 58.90% within a year), far exceeding market expectations of $29.4 billion (Ministry of Commerce and Industry, India) (see Figure 2).

India depends heavily on imported essential goods. Since most imports are priced in dollars, a weaker rupee makes them substantially more expensive. India’s largest import is mineral fuels, including crude oil, and when the rupee depreciates, the cost of oil rises sharply. This leads to higher petrol, diesel, and LPG prices, which then increase transportation and production costs across the entire economy, fueling high inflation.

Similarly, imports such as electrical machinery, computers, industrial machinery, plastics, iron and steel, and organic chemicals become costlier, raising the cost of manufacturing, infrastructure building, and everyday consumer goods. Industrial expansion slows as firms must spend more on imported capital goods.

The prices of gems and precious metals, including gold, also increase, widening the current account deficit and increasing pressure on foreign exchange reserves. Items like animal and vegetable oils, which India imports in large quantities, push food inflation higher when the rupee weakens.

Even technologically essential imports such as optical, technical, and medical apparatus, along with aircraft and spacecraft components, become more expensive, increasing healthcare costs and aviation costs for businesses and consumers.

Moreover, when the imports are expensive, the government is required to pay more of the devalued currency, which can lead to increased government spending. If there are more expenses than income, the revenue eventually decreases. Hence, a decrease in the value of currency indirectly has an impact on government revenue.

Figure 2. Source: Ministry of Commerce and Industry, ICRA Research

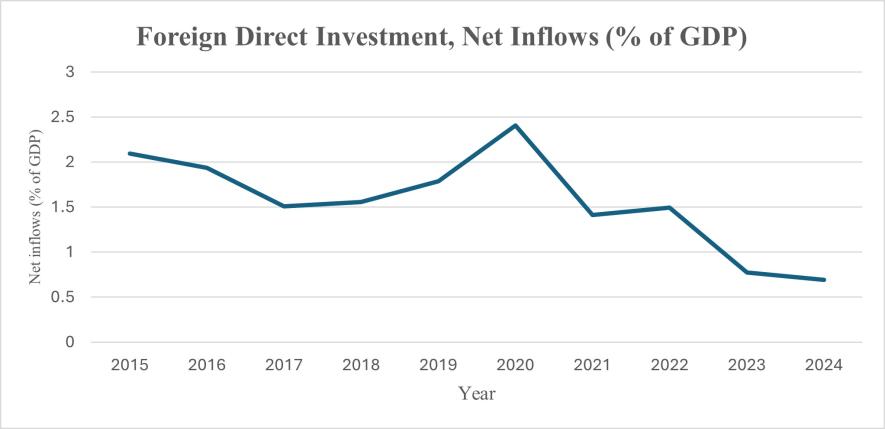

Currency depreciation adversely affects investor sentiment by eroding confidence in the domestic economy. This deterioration in confidence may prompt investors to withdraw from the Indian economy through the liquidation of holdings in the domestic equity market. Furthermore, both foreign portfolio investment and foreign direct investment are likely to decline, reflecting heightened uncertainty regarding macroeconomic fundamentals.

Such substantial capital outflows exert pressure on the balance of payments and contribute to the depletion of foreign exchange reserves, thereby undermining overall economic stability. Moreover, continued depreciation of the Indian rupee exacerbates these challenges, particularly in the context of an already significant decline in India’s net inflows of foreign direct investment (see Figure 3).

Figure 3. Source: World Development Indicators, IMF (2025)

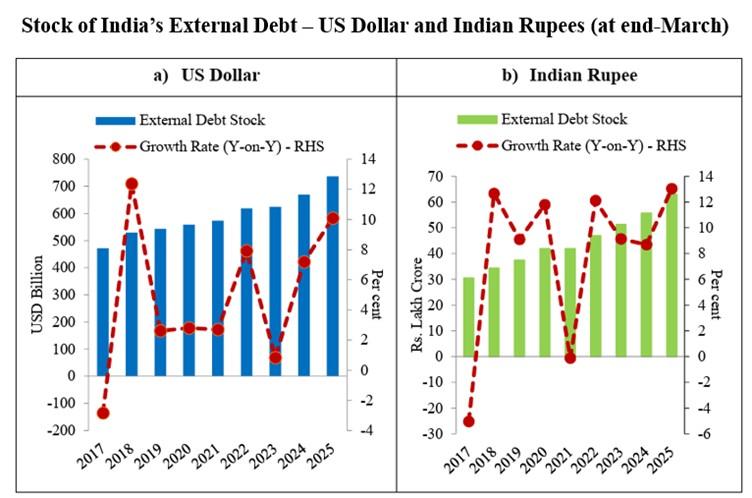

Weakening of the domestic currency will also lead to an increase in the burden of foreign debt on the economy. When there is depreciation in a currency, it requires more of the depreciated currency to pay off foreign debt, which is denominated in other currencies. This increases the cost of servicing the debt, ultimately leading to an increase in the debt burden. It will negatively affect the financial health of the Indian economy, as external debt in India has increased to an all-time high of $747200 million in the second quarter of 2025 from $736300 million in the first quarter of 2025 (Ministry of Finance, Government of India). Depreciation will only lead to making the situation worse in the case of India. From Figure 4, it is clearly visible that India’s external debt keeps on increasing in terms of dollars.

Another aspect of rupee depreciation in Indian economy, where several industries exist, is that each industrial sector reacts differently to the change in value of the currency. Industries that heavily rely on exports may usually benefit from a depreciation of currency, as exports are relatively cheaper when there is a devaluation of currency.

Figure 4. Source: RBI, Ministry of Finance

On the other hand, those industries that heavily rely on imported inputs are found to experience a negative impact as the depreciation cost of imports is high. In sum, we could conclude that the negative effect of rupee depreciation is far higher than the favourable effect of rupee depreciation for a country like India.

The writer is Senior Research Fellow, Department of Economics, Jamia Millia Islamia, New Delhi. The views are personal.

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.