Budget 2026-27: US-Centred Finance Capital Drives Fiscal Demand Squeeze

Image Courtesy: Flickr

The Union Budget 2026-57 is remarkable for being ever more compliant with the diktats of US-centred international finance capital. This becomes evident when the Budget 2026-27 is placed in context. The ruling neo-fascist dispensation in India has progressively compromised its strategic autonomy in ever more domains of the international political economy.

When the US government unleashed a unilateral trade offensive against India, the neo-fascist dispensation was unable to mount even an authoritative verbal counter-response. The consequent depreciation of the Indian rupee against the US dollar (which itself was depreciating against other major currencies) demonstrated the vulnerability of the Indian economy, as the neo-fascist dispensation expectedly desisted from pursuing international financial diversification within the framework of South-South Cooperation.

This adverse strategic trend continued with the dispensation's compromise with the US government's diktats on India's relations with Russia and Iran. This process of compromise has resulted in a so-called trade deal where the US government has not yet even fully restored the pre-trade offensive status, while the neo-fascist dispensation has allowed US monopoly capital to encroach on ever more sectors of the Indian economy.

This posture of strategic timidity and compromise informs the Union budget 2026-27, involving expenditure compression and regressive taxation, which are key markers of operating within the framework of US-centred international finance capital.

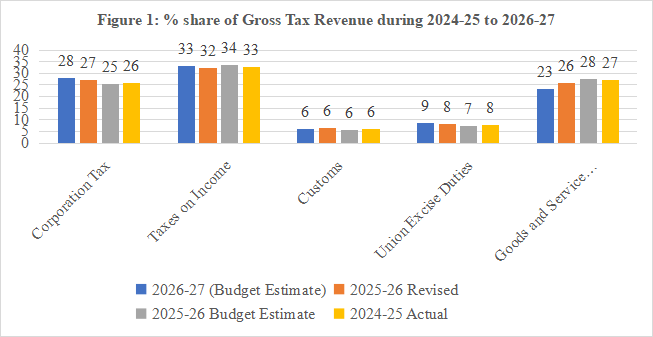

The intensification of the regressive tax structure in Budget 2026-27 involves a lower share of corporate tax and a higher share of income tax and indirect taxes. This regressive tax structure will increase inflation through the cost-push channel of indirect taxes (Goods and Services Tax and customs duty) and will involve demand compression, which disproportionately impacts the working people.

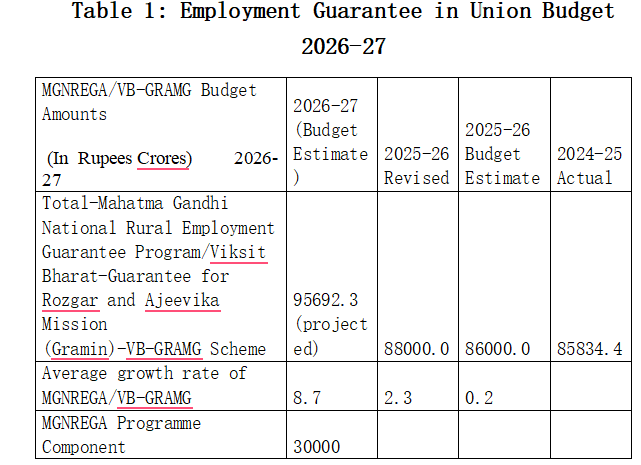

Along with this, public expenditure on health, education, agriculture and farmers' welfare, and employment guarantee are being affected, facilitated by the transition from the Mahatma Gandhi National Rural Employment Guarantee Scheme (MGNREGA) to the Viksit Bharat-Guarantee for Rozgar and Ajeevika Mission (Gramin) or VB-GRAMG Scheme.

Fiscal Demand Compression

The share of corporate tax revenue in gross tax revenue is lower at 28% in Budget 2026-27, while the share of income tax is at 33% and the combined share in gross tax revenue of GST and customs duty is at 29%. Figure 1 demonstrates that the share of corporate tax revenue in gross tax revenue tends to trend downward in the period 2024-25 to 2026-27.

Source: Authors constructed this figure by using Budget data of 2026-27.

Table 1 shows that the MGNREGA budget allocation was stagnant in the range of Rs. 86,000 crore to Rs. 88,000 crore in the two years 2024-25 and 2025-26. This meant that the average number of working days under MGNREGA was merely 50 days. The federal government deviously claimed that the replacement of MGNREGA by VB-GRAMG involved increasing the number of working days from 100 to 125. But this involves a sleight of hand that is both conceptual and computational.

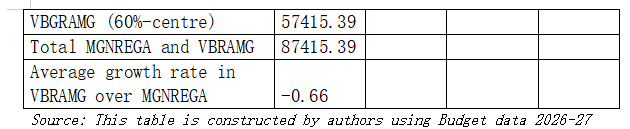

Conceptually, VB-GRAMG is a supply (i.e., government) determined employment programme, unlike the de jure demand-led MGNREGA. Besides, the Centre-states’ share in VB-GRAMG is 60:40, while it was 90:10 under MGNREGA.

Let us now turn to the computational sleight of hand. Budget 2025-26 projects that the nominal funding under GRAMG is Rs. 96,000 crore. The Centre’s share of this expenditure is 0.6 × Rs 96,000 crore, which is approximately Rs. 57,600 crore. The MGNREGA fund component is Rs. 30,000 crore, which implies that the total allocation by Centre is Rs. 57,600 crore plus Rs. 30,000 crore, amounting to Rs. 87,600 crore. This involves a nominal decline of Rs. 1,000 crore in 2026-27 as compared to 2025-26. Inflation will result in a further real decline. Besides, if state governments, which are being fiscally squeezed by the neo-fascist dispensation, are unable to contribute their 40% share of the projected Rs. 96,000 crore (approximately Rs. 38,400 crore), then the Union government can further cut its allocation.

What would be the funds required to increase employment to 125 days on average per worker? The difference between the VB-GRAMG stipulated 125 working days and the actual average working days under MGNREGA of 50 days is 75 days. This implies that the fund allocation required under VB-GRAMG must be two and a half times (=125/50= 2.5) in 2026-27 compared with the actual MGNREGA allocation in 2025-26, which was Rs. 88,000 crore. Thus, the VB-GRAMG allocation must be Rs. 220,000 crore (Rs 88,000 crore × 2.5). The Centre’s share of this amount would be Rs. 132,000 crore (=0.6 × 220,000 crores). The difference between the two demonstrates the epic proportions of the dispensation's chicanery. This is further compounded by the budget allocation for the Ministry of Agriculture, which is approximately Rs. 141,000 crore in 2026-27, involving a nominal increase of 0.2% but a real decline. This is in line with the adverse trend since 2024-25.

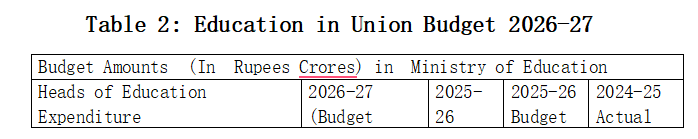

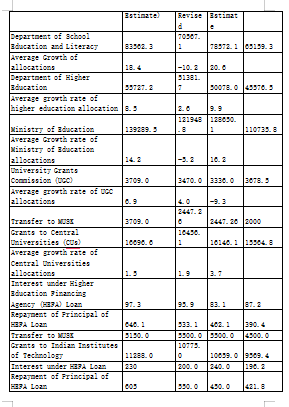

Some details about Budget 2026-27 as regards education are presented in Table 2. The Ministry of Education budget increased nominally by 14.2% from Rs. 122,000 crore in 2025-26 to Rs. 139,000 crore in 2026-27. The average inflation rate, based on the Consumer Price Index, from April to December 2025, reported by the Centre for Monitoring Indian Economy (CMIE), was 1.7%, implying a seemingly 12.5% real increase in the education budget. However, the revised budget for education in 2025-26, as compared to the budget estimate of the same year, declined by -5.2% (Rs. 6,700 crore). Thus, the rate of increase, comparing the two budget estimates for allocation to education, is reduced by more than half.

The higher education budget allocation increased by 8.5% nominally, while the real increase is 6.8%. The detailed allocation of grants to Central universities declined in real terms by 0.2%, as the nominal increase is a paltry 1.5%.

The allocation for the University Grants Commission (UGC) – currently under the threat of being replaced by the Viksit Bharat Shiksha Adhisthan (VBSA) or Higher Education Commission of India, if the relevant Bill is enacted – rose only by 5.2% in real terms, while the allocation for Indian Institutes of Technology increased only by 3.1% in real terms.

The announced increases in allocation for education are largely nominal, often failing to offset inflation and representing a stagnation in real terms. Sometimes they also involve statistical increases over steep past cuts in allocations that involve limited or no increases when seen over a multi-year period.

Furthermore, the union government has engaged in the oft-repeated sleight of hand, whereby revised estimates for public expenditure on education tend to fall below the original budget estimates. Besides, the Centre has exaggerated claims about public education spending that involve budgeting allocations to funds such as the Madhyamik and Uchchtar Shiksha Kosh (MUSK). This does not constitute any public expenditure on education; it is merely a financial transfer between two Union government accounts.

Allocations under the Budget 2026-27 to Central universities and vital bodies such as UGC have seen negligible real growth, reflecting a deliberate neglect of publicly funded higher education. The Budget 2026-27 continues the trend of shifting the composition of funding for education from direct grants to loan-based mechanisms, thereby further commercialising education.

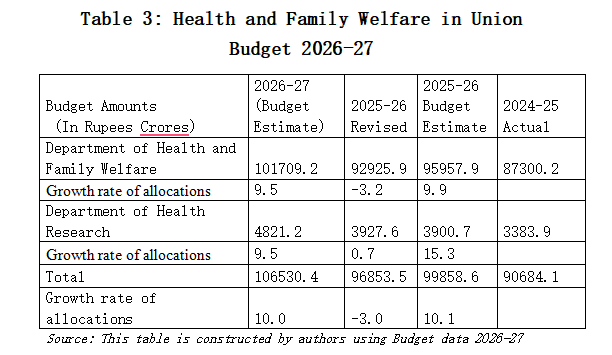

Similar adverse trends are visible in the allocation for health and family welfare, some of which are set out in Table 3. The allocation for the Ministry of Health and Family Welfare increased nominally by 10% to Rs. 107,000 crore in 2026-27. However, the revised estimates of last year's budget involved a negative growth rate of 3.0% as compared to the budget estimates for 2025-26. The actual increase between the two budget estimates was therefore significantly lower.

Conclusion

The Union budget 2026-27 has been in line with the diktats of US-centred international finance capital. The elaborate obfuscations regarding demand compression through fiscal means have involved the processes described in the foregoing, as well as talking up various initiatives with little or no resource allocation.

The acquiescence of the neo-fascist dispensation's budget-making to US-centred international finance capital involves the central process of fiscal consolidation, which is a euphemism for fiscal demand compression that is organically interrelated with Indian monopoly capital's entanglement with US-centred international finance capital.

An alternative to this posture of strategic compromise requires a decisive effort to reorient Indian trade and finance away from US-centred international finance capital and toward a process centred around South-South Cooperation, which will necessarily involve capital controls. Such a reorientation is a necessary condition for the concerns of the working people (employment, living wages, health, education, etc.) acquiring centrality.

Narender Thakur is Professor, Department of Economics, Dr. BR Ambedkar College, University of Delhi. C. Saratchand is Professor, Department of Economics, Satyawati College, University of Delhi. The views are personal.

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.