The 300% Penalty Trap: Why NRIs and Their Families Deserve Clarity, Not Punishment

In late 2025, thousands of NonResident Indians (NRIs) began receiving notices warning of a 300% penalty under FEMA (Foreign Exchange Management Act). The letters were blunt, the headlines alarming: “Severe fines for account misuse.” For many families, this was the first time they had even heard of such a clause. Young professionals abroad wondered what they had done wrong, parents feared that gifts from their children might now be treated as violations, and elderly NRIs felt punished for ordinary acts like receiving pensions or collecting rent.

The confusion stems from fragmented rules. Residency is defined under the Income Tax Act, while RBI borrows that definition to frame account schemes (NRE, NRO, FCNR). Enforcement, however, falls under FEMA. Banks often failed to educate customers, treating resident accounts as interchangeable with NRO/NRE. Families now feel punished for lapses they never knowingly committed.

Why Resident Accounts Become a Compliance Trap

The trigger is deceptively simple: once an individual spends more than 182 days abroad in a financial year, they are automatically classified as an NRI. Yet banks rarely explained this transition. Customers continued using resident savings accounts, unaware that the account type no longer matched their legal status.

Operating a resident account after becoming an NRI creates three failures: taxation gaps (income bypasses TDS), capital control distortions (wrong regime applied), and data errors (misclassified inflows appear domestic). For years, banks tolerated this misuse, RBI focused on aggregate inflows, and citizens assumed compliance was automatic. The shock in 2025 was not a new law but sudden enforcement of an old one.

Section 13 of FEMA, which allows penalties up to three times the sum involved, has existed since 2000 — but for decades it remained dormant, tolerated by banks and overlooked by regulators.

Human Cost of Negligence

An elderly pensioner in the US tried to convert her resident account into an NRO account, but digital outages left the process incomplete, exposing her to violation risk despite her intent to comply. A Dubaibased landlord continued using his resident account for rent and consultancy income, remitting crores abroad, now facing potential penalties in the range of ₹7.5 crore. A Canadian professional remitted modest sum to India and repatriated rent, only to discover that misclassification could expose her to penalties of 300% of the amount.

These stories reveal a common truth: the victims are ordinary citizens, not deliberate evaders. Institutional negligence created the trap, and sudden enforcement without education amplified fear, turning technical lapses into existential anxiety.

Clarifying Income and Transfers

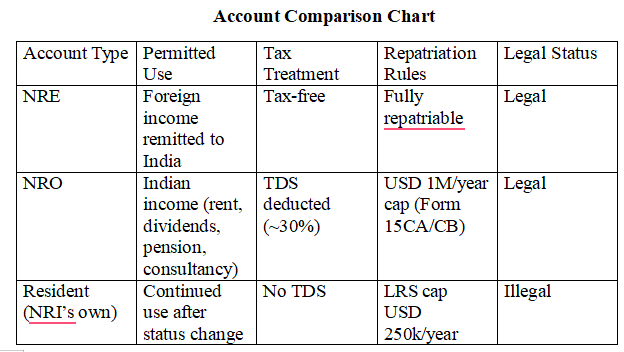

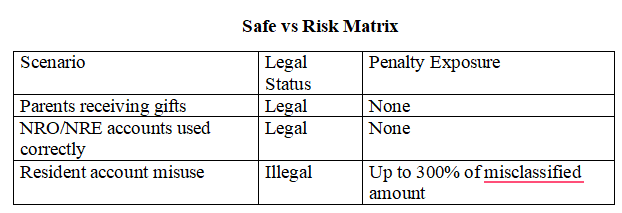

The panic made many NRIs anxious, fearing that even normal gifts or remittances could be punished. In reality, family gifts sent by children abroad to parents in India are exempt from tax and safe. NRE accounts handle foreign income taxfree and fully repatriable, while NRO accounts manage Indian income with TDS and capped repatriation.

The real danger lies only in NRIs continuing to operate their own resident accounts after crossing the 182day threshold abroad. Rent, dividends, and consultancy fees credited here bypass TDS, outward transfers bypass the $1million cap, and misclassification distorts RBI’s forex data. This misuse attracts FEMA penalties up to 300% of the misclassified amount.

“For many NRIs, the fear is not about complex clauses — it is the dread that ordinary rent, dividends, or consultancy income could suddenly be branded illegal.”

The Rupee Trap — Why Enforcement Tightened

The sudden strictness around FEMA penalties is tied to the rupee’s vulnerability. Every time NRIs transfer funds abroad, banks must sell rupees and buy dollars, increasing dollar demand and weakening the currency. Misuse of resident accounts bypasses FEMA’s repatriation cap, creating uncontrolled outflows.

Several pressures converged in 2025: persistent rupee depreciation, blind spots in RBI’s reserve data due to misclassification, fiscal leakage from untaxed income, and credibility concerns with global investors.

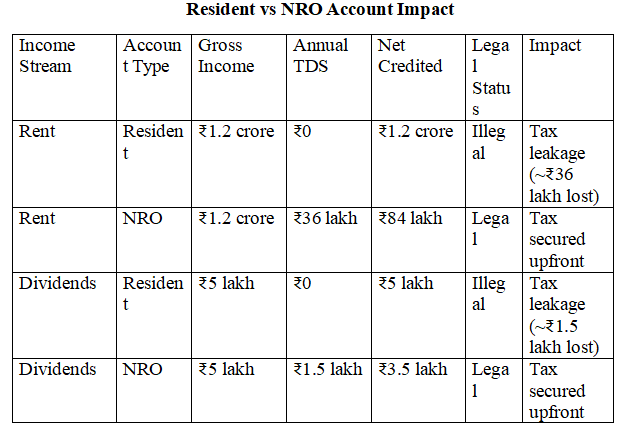

This vulnerability is not abstract. It shows up directly in how different account types handle income streams. A simple comparison of resident versus NRO accounts reveals how misclassification leads to tax leakage and distorted data, while proper compliance secures revenue upfront.

The numbers in this table highlight the scale of leakage. What looks like routine income — rent, dividends, consultancy fees — becomes a fiscal blind spot when credited to Resident accounts. To grasp the magnitude of risk, it helps to translate these figures into a single quantified case study

Quantified Case Study

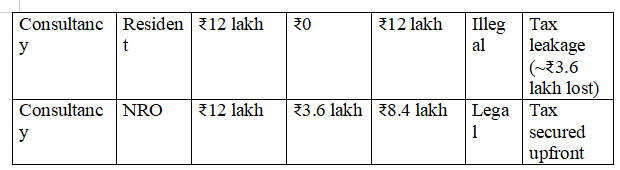

Misclassifying ₹1.37 crore annually — made up of ₹1.2 crore in rent, ₹5 lakh in dividends, and ₹12 lakh in consultancy income — creates tax leakage of over ₹41 lakh per year. Under FEMA Section 13, penalties can reach up to three times the misclassified amount, meaning exposure exceeding ₹4 crore annually. Importantly, the 300% penalty is levied on the misclassified transaction value itself — not merely on the tax lost — which is why exposure multiplies so sharply. Over three years, the risk surpasses ₹12 crore.

This is where the fear becomes tangible. Once penalties are applied under FEMA’s 300% rule, the exposure multiplies rapidly. The following chart shows how a single misclassified account can escalate from lakhs in leakage to multicrore penalties within just a few years.

|

“One misclassified account can trigger penalties of over ₹12 crore in just three years.” |

|

|

|

Reform Proposals

The 300% penalty panic reflects systemic failures, not deliberate evasion. To restore trust and protect both the diaspora and the rupee, reforms must be comprehensive. The RBI and the government should issue clear advisories in plain language, create grievance portals, and use embassies for diaspora outreach. Penalties must be rationalised to distinguish between wilful evasion and institutional negligence.

Banks must automate reclassification alerts, enable remote KYC for elderly NRIs, and train staff to guide customers correctly. Public education campaigns, simplified guides, and fintech partnerships can ensure citizens understand compliance rules. With reforms, India can achieve three goals simultaneously: protect citizens from unnecessary fear, secure tax revenues by plugging leakage, and stabilize the rupee by controlling forex outflows.

Conclusion — From Panic to Reform

The sudden surfacing of FEMA’s 300% penalty clause has jolted the diaspora. For decades, misuse of Resident accounts was tolerated—even normalized—by banks and regulators. Families assumed compliance was automatic. Now, enforcement has tightened abruptly, and ordinary citizens feel exposed to punitive measures they never anticipated.

The truth is simpler than the panic suggests. Parents receiving gifts from children abroad are safe. NRIs using NRO/NRE accounts correctly are safe. Only those who continue to operate Resident accounts after crossing the 182day threshold abroad face genuine exposure.

This clause has existed for decades; what changed in 2025 was its sudden strict enforcement. As shown earlier, penalties apply to the misclassified amount itself, not just the tax lost, which is why exposure multiplies so sharply.

The deeper fault lies not in citizens’ intent but in institutional negligence. Enforcement is necessary, but it must be paired with reform: clear advisories, proactive alerts, digital KYC options, transparent RBI communication, and penalties proportionate to intent.

This episode reflects a larger tension: between the State’s need for fiscal discipline and the citizen’s need for clarity; between currency stability and diaspora trust. If reforms follow, this moment of shock could become a turning point—where India finally builds a compliance system that is fair, transparent, and citizencentric. Until then, NRIs must tread carefully, ensuring their accounts are correctly classified, while policymakers must remember that trust is as important as compliance in safeguarding both the rupee and the nation’s credibility.

The writer is a CAIIB (Certified Associate of the Indian Institute of Banking and Finance), has 37 years of work experience in the private sector and in a nationalised bank, and is the All India Deputy General Secretary of the All India Bank Officers’ Confederation.

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.